explore the municipal revenue gap

Municipal managers are trained to manage expense.

Contracted studies are also expense-focused.

As a result, revenue options,

especially non-tax ones, don’t get much consideration during budget prep, or otherwise.

By “non-tax” revenue, we mean:

Locally-controlled, own source revenue options, (not grant funding or financing to repay);

Not property taxes or or payments in lieu of them; and

Sources currently available for municipal use, (not ones that require provincial policy changes first).

benefits of looking at non-tax revenues

Top Benefits of Examining Non-tax Revenues

1. De-stress the budget process.

Finance staff often balance municipal budgets within Council-approved tax targets by accepting the challenge on the expense side. And it’s worked, but past effectiveness makes the task seem manageable the next year, while the law of diminishing returns suggests it is less and less the case. Meanwhile, it’s harder to get warning signals to register politically each year staff handle a gap through cost control and the pressure on staff to pull it off again heightens.

Eventually, staff-led cost-control won’t be enough. At that point, the budget challenge returns to Council for a political decision: Higher taxes, service changes or more non-tax revenues.

Accepting that there are limits on staff’s ability to shrink expense to fit a tax target that no number of evenings and weekends pouring over spreadsheets can overcome is setting a healthy boundary, one that’s badly needed in Finance during budget season.

2. You’re richer than you think.

It’s no secret politicians like announcing new money and prefer staff lead on revenue.

It works out differently for municipalities than for other governments though: To paraphrase Wayne Gretzky, when staff mirror modest political interest in revenue, municipalities ‘miss 100% of the money they aren’t looking for.’ Asked about how much time her municipality spends examining non-tax revenue options in the lead-up to budget launch, one Treasurer reported, “About 5%.”

In budget deliberations, the combination of peak workload for staff and a somewhat passive revenue posture on Council that’s reflected in management can imply that ‘there aren’t real alternatives to what we do now.’

But by not looking, municipalities can’t know how much they’re leaving on the table.

If you’re planning to take a different approach to revenue this cycle, facilitating a discussion resulting in Council support for criteria staff should use to determine the kinds of revenue proposals that make it into the proposed budget is a useful step. It confirms Council readiness to make a decision and narrows the workload, eliminating any time spent on options that there is no political will to implement. Common criteria include potential yield, time and cost to implement and whether opportunities present one-time or recurring revenue streams. Incidence and connection to Council priorities are others we recommend.

revenue services

1. ‘Money Now’

We all know there’s more than one way to pay.

“Money Now” is a service for Treasurers who need alternative revenue options quickly, usually based on budget timelines, so they can give Councils:

Choice about how to pay for their commitments;

A bigger budget envelope to get more done, faster; or

A lower tax requirement, using the options as substitutes for levy increases.

2. Revenue Review

There are many ways to generate the same dollar amount, and since how a municipality generates revenue influences more than its own account balances, there are opportunities to reverse-engineer revenue around the ways Council wants to influence a community.

Reviews are for public finance leaders in forward-thinking places ready to ask more of their revenue. They are commonly initiated to:

Ensure alignment between an existing revenue profile and new priorities, (a new Council or a new Strategic Plan);

Mind the revenue source mix and incidence of rates while taking in more revenue to increase investment in infrastructure; or

Compensate for anticipated revenue decreases in a deliberate, measured way (i.e. preparing for grant shrinkage or reformulation, or the rescinding or redesign of existing own source revenue tools).

articles

[ mini-series ]

YIELD: Municipal Revenue at a Crossroads?

other business

- property tax

- own source revenue

- non-discretionary expense

- asset management

- discretionary activities

- tax bill

- externalities

- balanced budget

- own source revenue capacity

- development charges

- exception

- change-makers

- demonstrating value

- demand variability

- cost of growth

- cost of administration

- tax increases

- business as usual

- revenue shortfall

- reporting structure

Email this page with Outlook

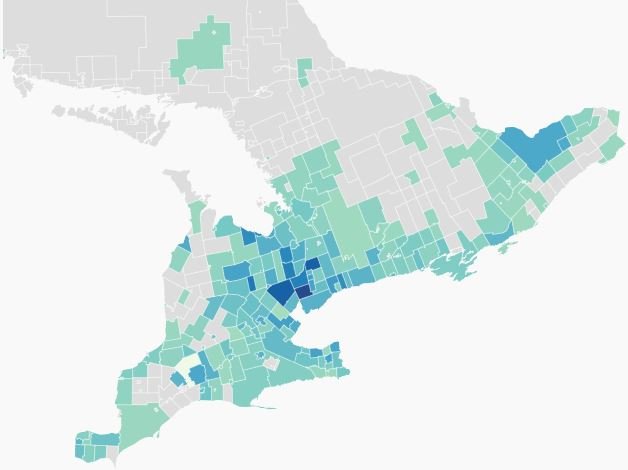

External shocks and legislative design decisions combust in municipal budget deliberations, giving Councils more credit for undesirable situations than they have control over them because the conflicts preceding budget approval are newsworthy and the final decision about how to respond happens in Council chambers.

Though broadly discrediting to municipal institutions and actors, the sequence unfolds in ways that are more damaging to economically disadvantaged areas and more damning for their municipal leadership.